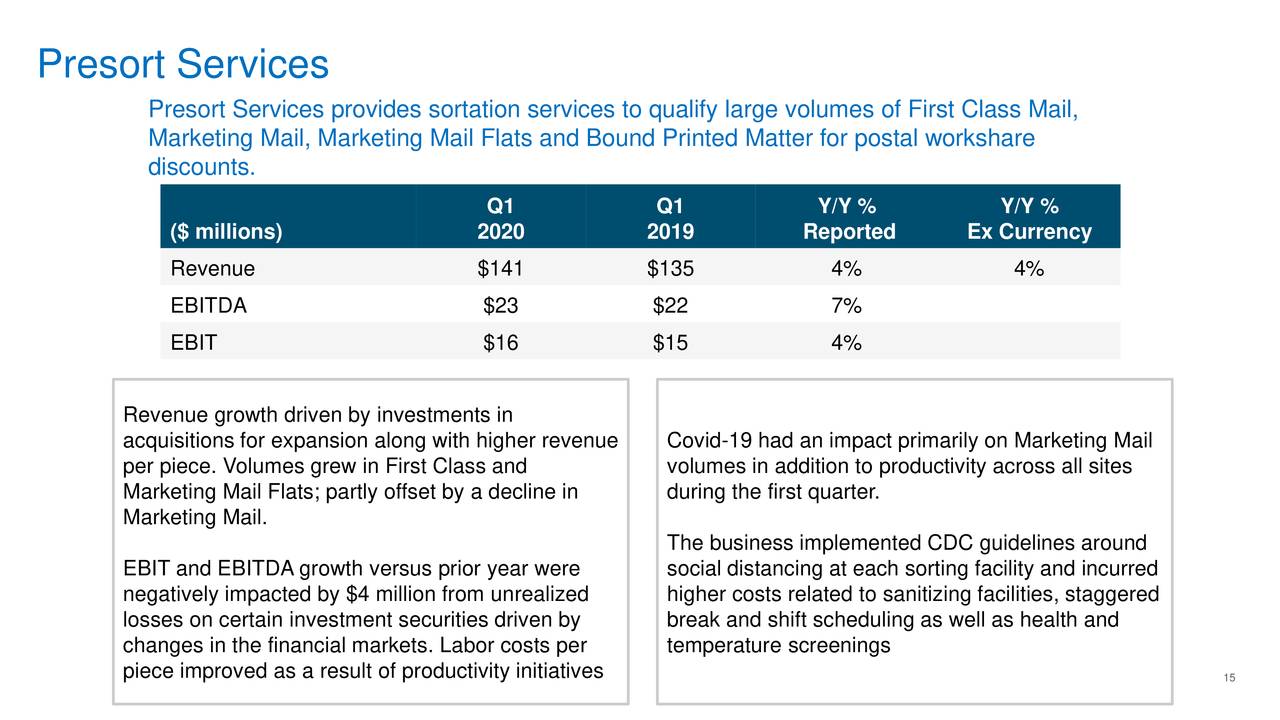

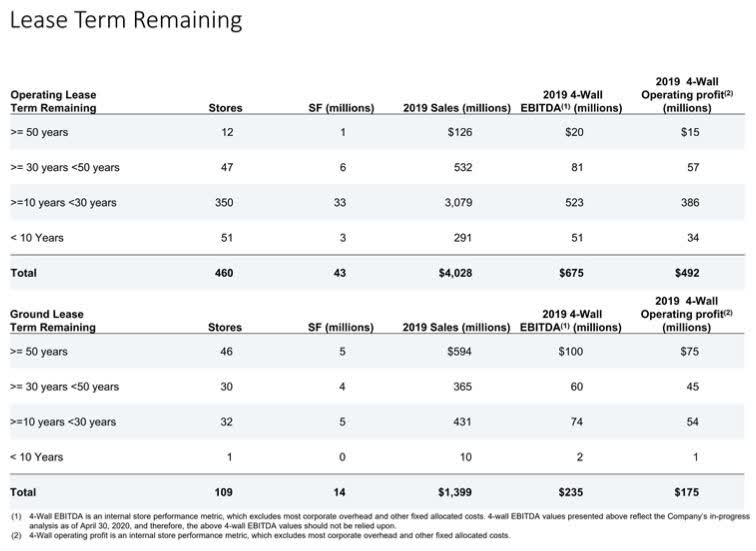

4 Wall Ebitda Analysis

It doesn t include things like corporate overhead head office labor and so on.

4 wall ebitda analysis. Non ho trovato niente in italiano come 4 wall quindi io lo tradurrei come punto vendita filiale a seconda. Managing to your store p l will create greater overall profits then simply reading the results at month end. 4 wall is an allusion to a store or box as some people call a retail store with four walls. Rh gallery is a us based example that has a non 4 wall philosophy with their source book store galleries and the associated cross channel sales lift in the markets they serve.

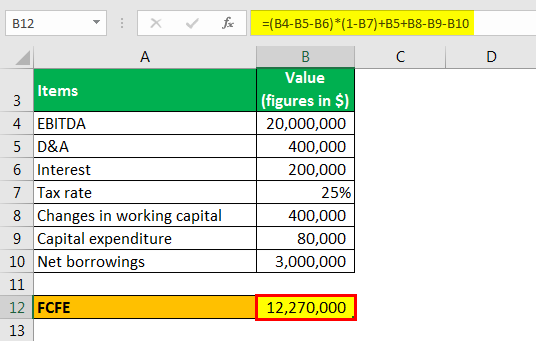

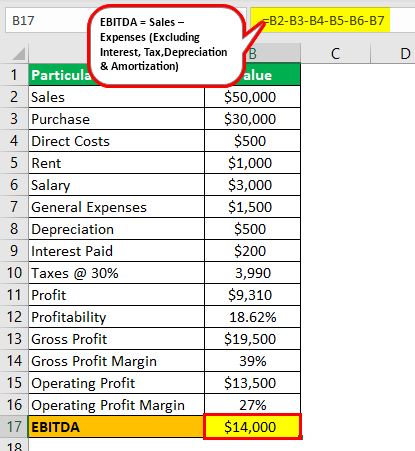

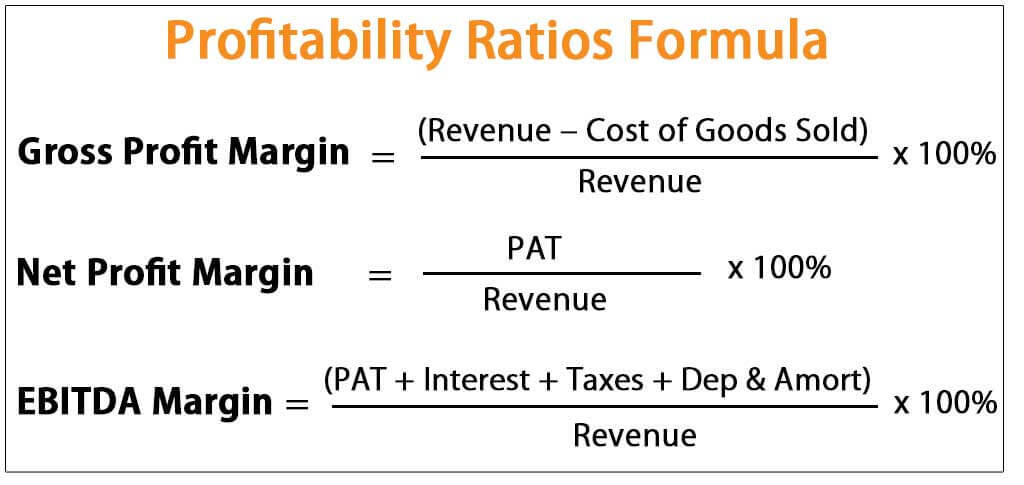

Ciao elena scusa hai ragione tu non avevo letto bene la tua domanda. Each retail store will have its own set of key revenue and expense line items. It includes cogs labor rent and other 4 wall expenses. Taking out interest taxes depreciation and amortization can make completely unprofitable firms appear to be fiscally healthy.

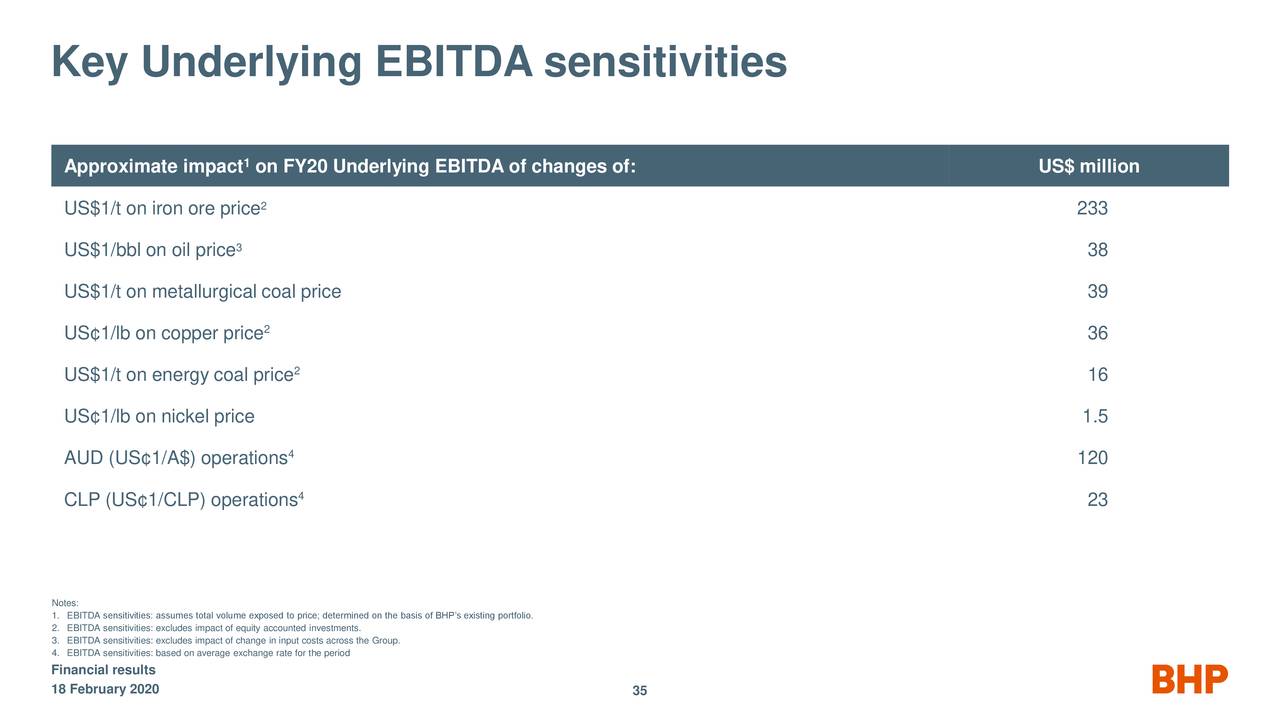

For the best answers search on this site https shorturl im eqg5w. The 4 wall ebitda is the ebitda for the retail store itself. What does quot 4 wall ebitda quot. Un ebitda supérieur à 0 signifie que le cycle d exploitation de l entreprise dégage une rentabilité.

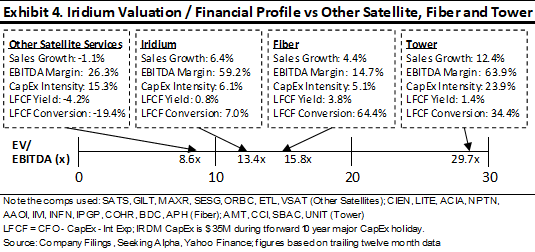

L ebitda mesure la création de richesse avant toute charge calculée. Quot 4 wall ebitda quot differ regular ebitda. 4 wall is a term related to retail stores. This would indicate widespread problems across the company or.

L ebitda ebe est un indicateur financier figurant dans le tableau des soldes intermédiaires de gestion sig il représente le flux de trésorerie provenant de l exploitation et permettant à la fois de développer l. Can ebitda multiple be negative. C est l équivalent de l excédent brut d exploitation ebe. Maybe we shouldn t be even trying to attribute sales to a specific touch point like the last touch model as the consumer s decision process is often impacted by many brand interactions not just the.

A retail store will incur certain expenses that are only related to the operations that take place within the. Also called four wall cash flow or four wall margins it reflects the sales of each store relative to the direct costs required to operate the store such as rent utilities wages inventory. à l inverse un ebitda inférieur à 0 est mauvais signe et montre un cycle d exploitation non optimal. The ebitda within the 4 walls of that store as opposed to the company s ebitda as a whole grazie a tutti in anticipo.

A look back at the dotcom companies of. A four wall analysis provides a simple yet effective way of managing the moving financial parts. Yes if the ebitda for a company is negative then its ebitda multiple can also be negative. It means the.

Attention notez que l ebitda tout comme l ebe en france ne montre pas la rentabilité globale du. Critics of ebitda analysis.